Please Sign in to view recently saved searches.

24 Jun 2025

China's Urea Market in May 2025: Import Boom, Export Collapse

Keywords

China's Urea Trade Sees Wild Swings as Policy Shifts Reshape Global Market

China's urea market experienced dramatic shifts last month, with imports skyrocketing year-on-year while exports remained a fraction of 2024 levels. Meanwhile, domestic production rose, and new customs inspections added uncertainty to global trade flows.

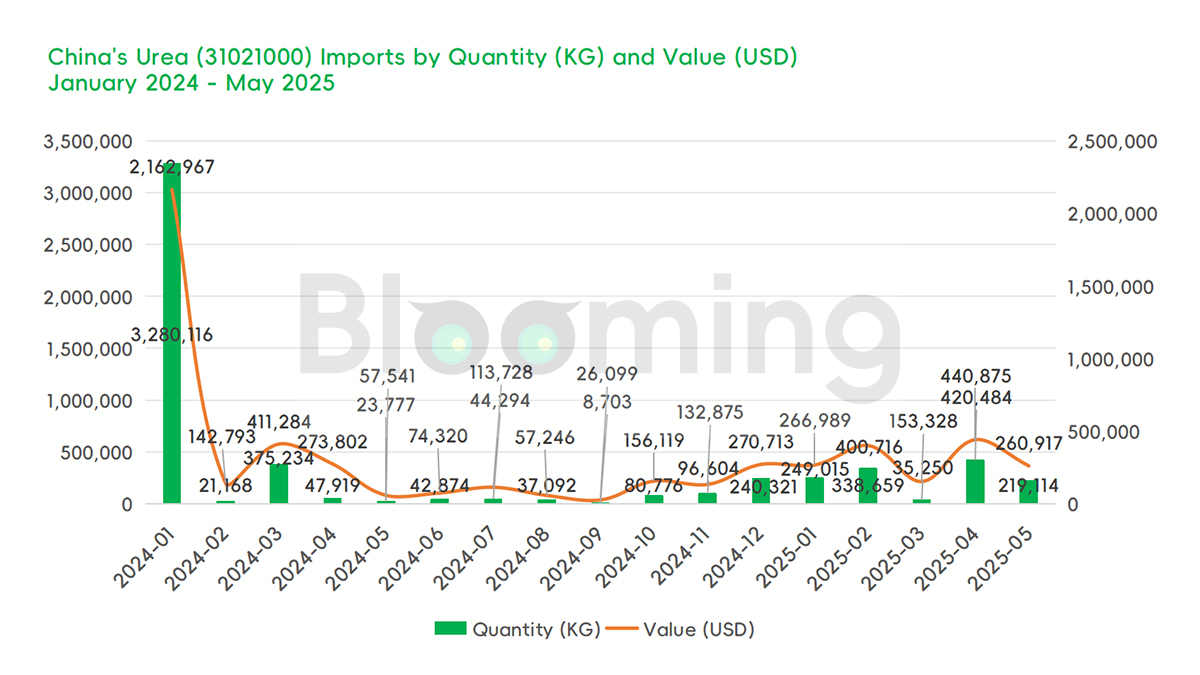

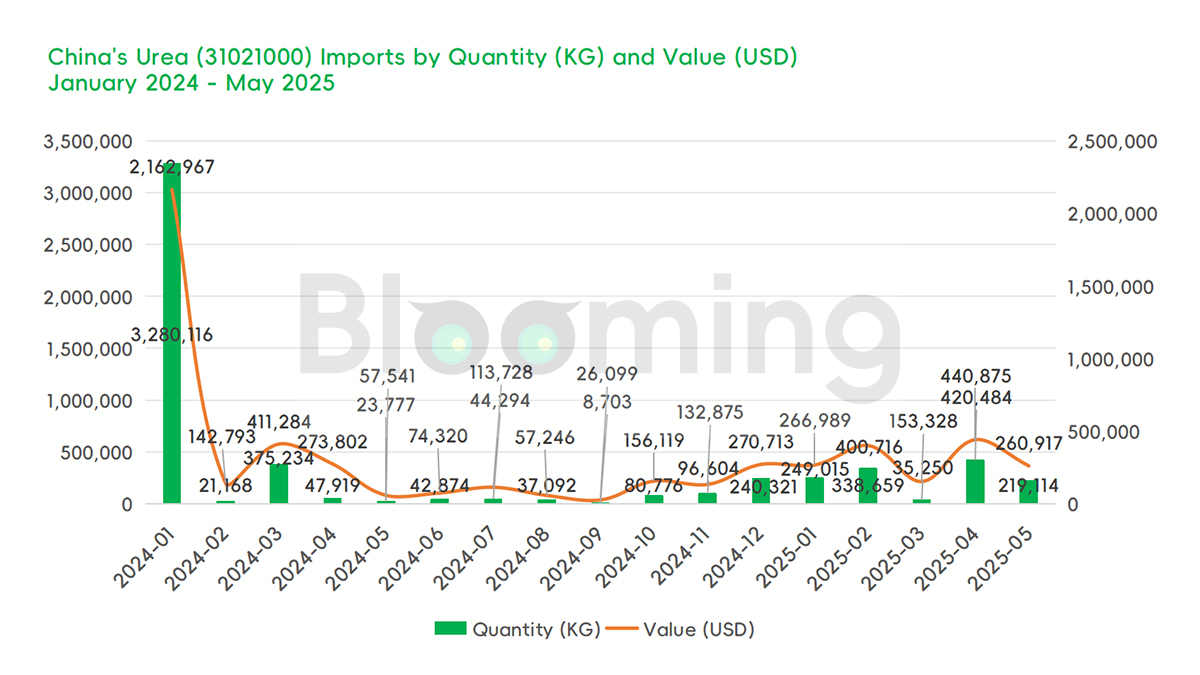

Import Surge: Short-Term Dip, Long-Term Spike

China's urea imports in May totaled $260,917, down 40.82% month-on-month (MoM) but up a staggering 353.45% year-over-year (YoY). In volume terms, imports reached 219,114 kg, a 47.89% MoM drop but an 821.54% YoY explosion. The shipments came from nine trading partners, signaling diversified sourcing despite the monthly slowdown.

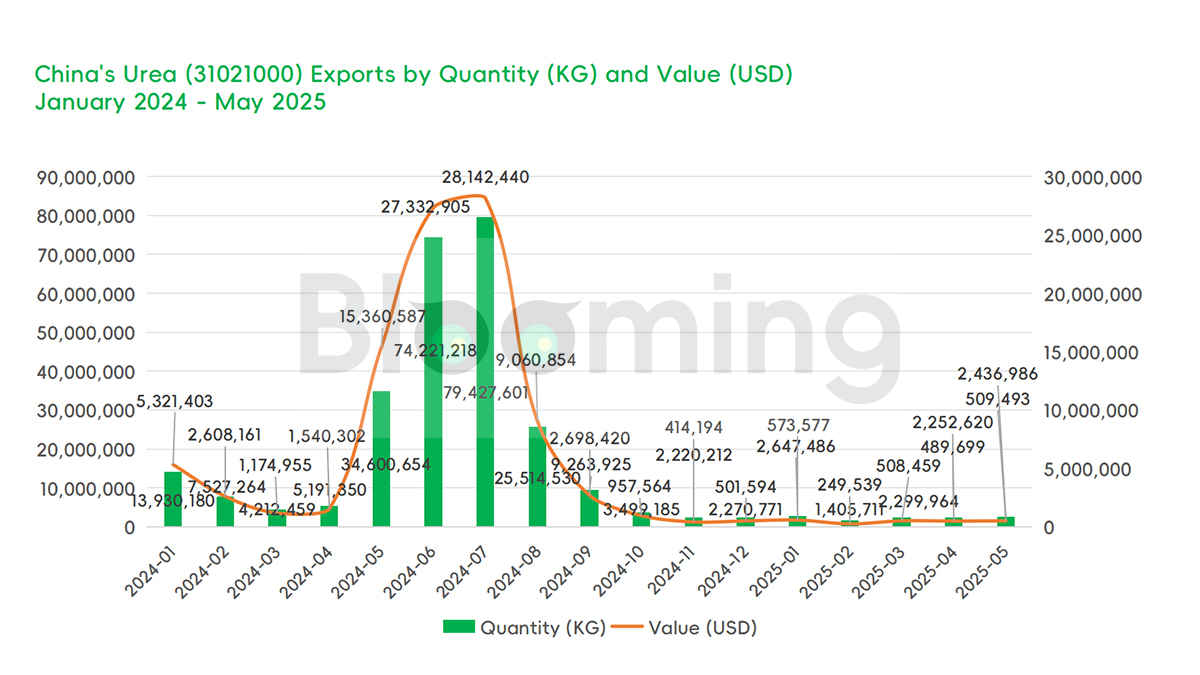

Export Crisis: Slight MoM Recovery, But 97% Below 2024 Levels

Exports told a different story. While urea export value edged up 4.04% MoM to $509,493, it remained 96.68% lower than May 2024. Volume followed a similar trend, rising 8.18% MoM to 2,436,986 kg but collapsing 92.96% YoY. Shipments were restricted to just two destination countries, reflecting China's tightened export controls.

Domestic Market: Rising Output, High Inventories, Mixed Prices

At home, China's urea inventories stood at 980.6k mt by May 28, while production climbed 7.72% MoM to ~6.28 million mt. Profitability improved, with the aerospace furnace process averaging RMB 310/mt (+4.73% MoM). However, prices were mixed-Linyi's spot price fell to RMB 1,880/mt by month-end, though the monthly average rose 1.11% to RMB 1,899.7/mt.

Global Ripples: Policy Uncertainty Sparks Volatility

China's urea export policy whipsawed global markets. Early-month bullish sentiment turned bearish as customs inspections began on May 26, imposing a 7-day approval process. Prices reacted sharply:

- Middle East urea ↓$20/mt

- China's small-grade urea ↑$97/mt MoM

- Brazil CFR prices rebounded to $385-410/mt

- U.S. barge prices fluctuated wildly ($410-555/mt FOB)

Outlook: Will China's Export Curbs Ease?

With domestic production rising and global demand still strong, market watchers are questioning whether China will adjust its restrictive policies. For now, traders brace for more turbulence as the new customs regime takes hold.

For the full report of China's Urea Market in May 2025: Import Boom, Export Collapse, please contact [email protected].

Disclaimer: Blooming reserves the right of final explanation and

revision for all the information.