Please Sign in to view recently saved searches.

Home

Media

Product Analysis

China’s Phthalic Anhydride Trade in April 2025: Exports Cool While Imports Surge

22 May 2025

China’s Phthalic Anhydride Trade in April 2025: Exports Cool While Imports Surge

Keywords

I. Export Analysis

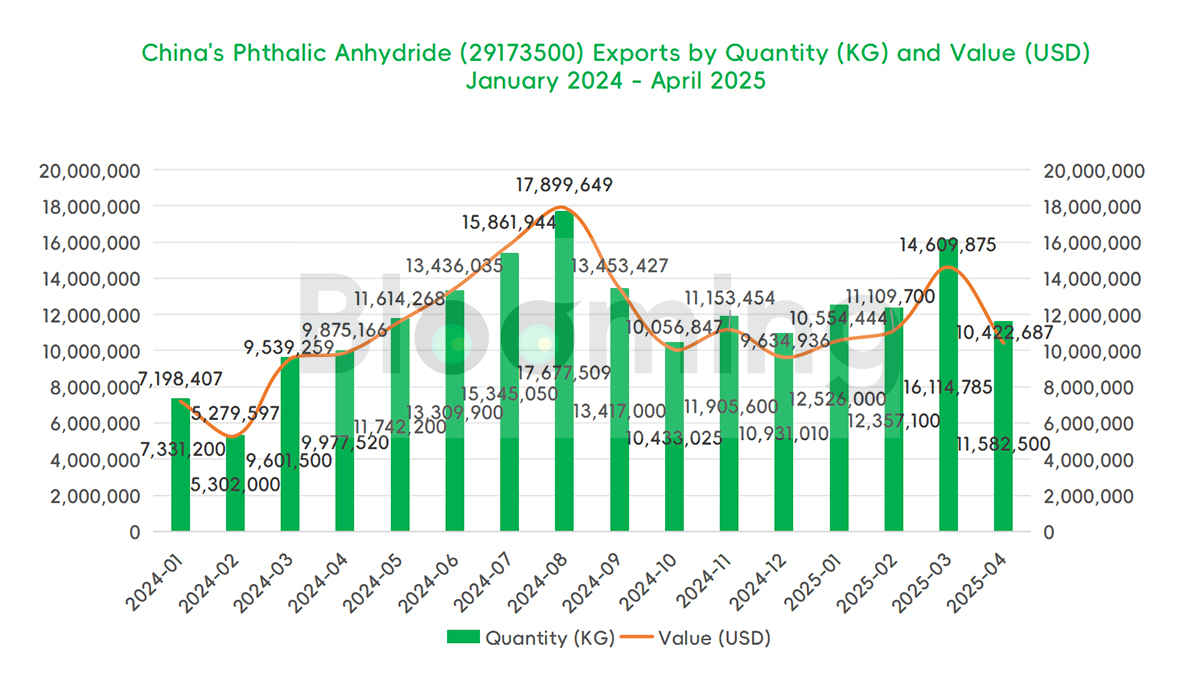

In April 2025, China's phthalic anhydride exports continued to grow year-on-year, though export volumes declined from the previous month. According to the latest customs data, China exported 11,582.5 metric tons of PA in April, generating export revenue of USD 10.42 million. The average export price stood at USD 899.87 per ton. Compared to April 2024, export volumes rose by 16%, underscoring a strong annual growth trend. However, volumes fell by 28% month-on-month, reflecting a short-term market adjustment.

Notably, China exported a total of 52,580 tons of PA in the first four months of 2025, marking a substantial 63% increase from the same period in 2024. This indicates a continuous enhancement in the global competitiveness of Chinese PA products.

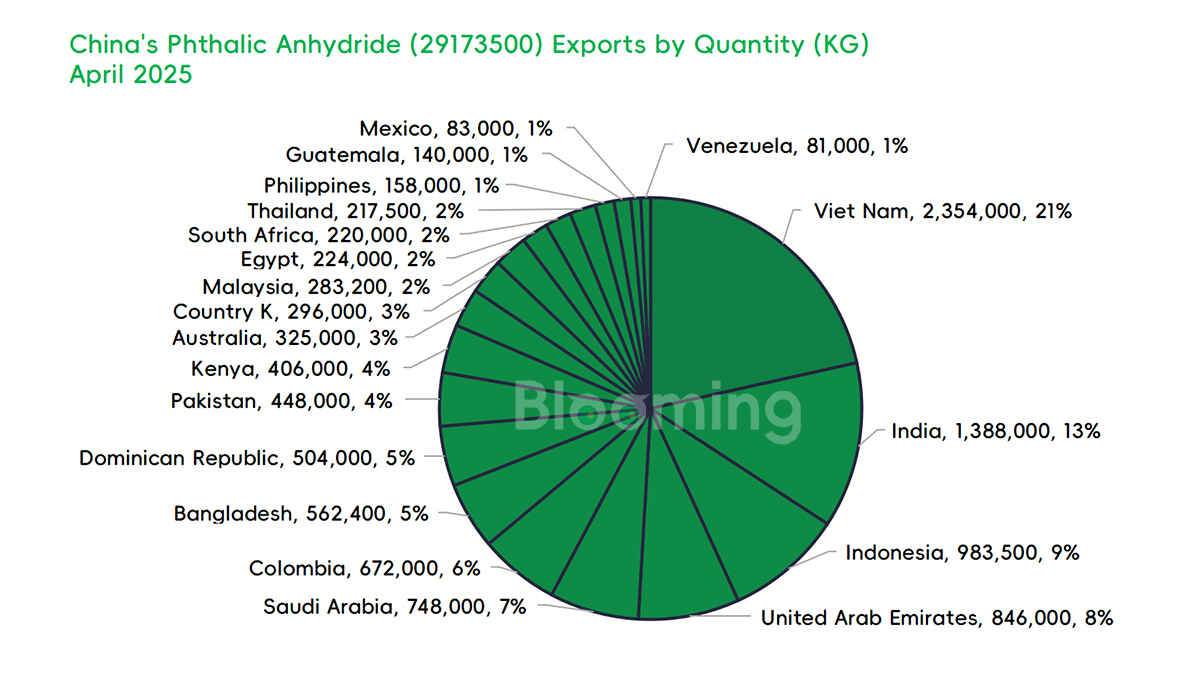

In April, China exported PA to 33 countries and regions. The top 10 destinations accounted for 76.3% of total export volume, indicating a relatively concentrated and stable trade structure. Vietnam became China's largest export market for PA, importing 2,354 tons (20.2%), overtaking India, which imported 1,388 tons (11.9%). Indonesia (983.5 tons, 8.4%) and the UAE (846 tons, 7.2%) ranked third and fourth, respectively - highlighting strong demand from Southeast Asia, South Asia, and the Middle East. Emerging markets such as Saudi Arabia (748 tons, 6.4%), Colombia (672 tons, 5.8%), and Bangladesh (562.4 tons, 4.8%) also contributed significantly to overall demand. Although African and Central American markets - such as Kenya and the Dominican Republic - currently account for smaller shares, their growth potential warrants attention. Overall, while Asia remains the core export region, China's PA trade is steadily expanding into Latin America, the Middle East, and Africa.

Export supply sources were concentrated across 12 provinces and municipalities, with a clear regional clustering effect. North and East China remained the dominant supply regions. Shandong Province led all regions with a 28% share of total exports, reaffirming its central role in China's PA industry. Beijing followed with 22%, underscoring North China's strategic importance in PA trade. Jiangsu, Hebei, and Zhejiang also formed part of this regional supply hub, collectively accounting for over 50% of total exports. These figures reflect the advantages of well-established chemical industry chains and strong foreign trade infrastructure in these regions. Looking ahead, new production capacity in Central and Western China may emerge as a key driver of future growth.

II. Import Analysis

China's phthalic anhydride imports showed a temporary rebound in April 2025, with monthly import volume reaching 326.3 tons - up 106% month-on-month and 95% year-on-year. The average import price was USD 1,163.63 per ton. Despite this short-term increase, total imports for the January–April period stood at just 1,095 tons, down 15.6% compared to the same period last year. This points to a continued decline in long-term import demand.

China's PA imports remained concentrated in two traditional supply sources: Taiwan (China) and South Korea. Guangdong Province continued to serve as the primary import hub.

The ongoing surplus in China's domestic PA production capacity, coupled with intense price competition, has reinforced the price-performance advantage of domestic products. This is the key reason behind the persistent decline in import dependency. While April's data showed a temporary recovery in imports, the outlook remains subdued. With domestic supply remaining ample and cost advantages firmly in place, China's PA import volumes are expected to stay at historically low levels in the foreseeable future.

For the full report of China's Phthalic Anhydride Imports and Exports - April 2025, please contact [email protected].

Disclaimer: Blooming reserves the right of final explanation and

revision for all the information.