Please Sign in to view recently saved searches.

Home

Media

Product Analysis

China's Titanium Dioxide Trade Sees Strong Monthly Rebound in March 2025 Despite Year-on-Year Decline

07 May 2025

China's Titanium Dioxide Trade Sees Strong Monthly Rebound in March 2025 Despite Year-on-Year Decline

Keywords

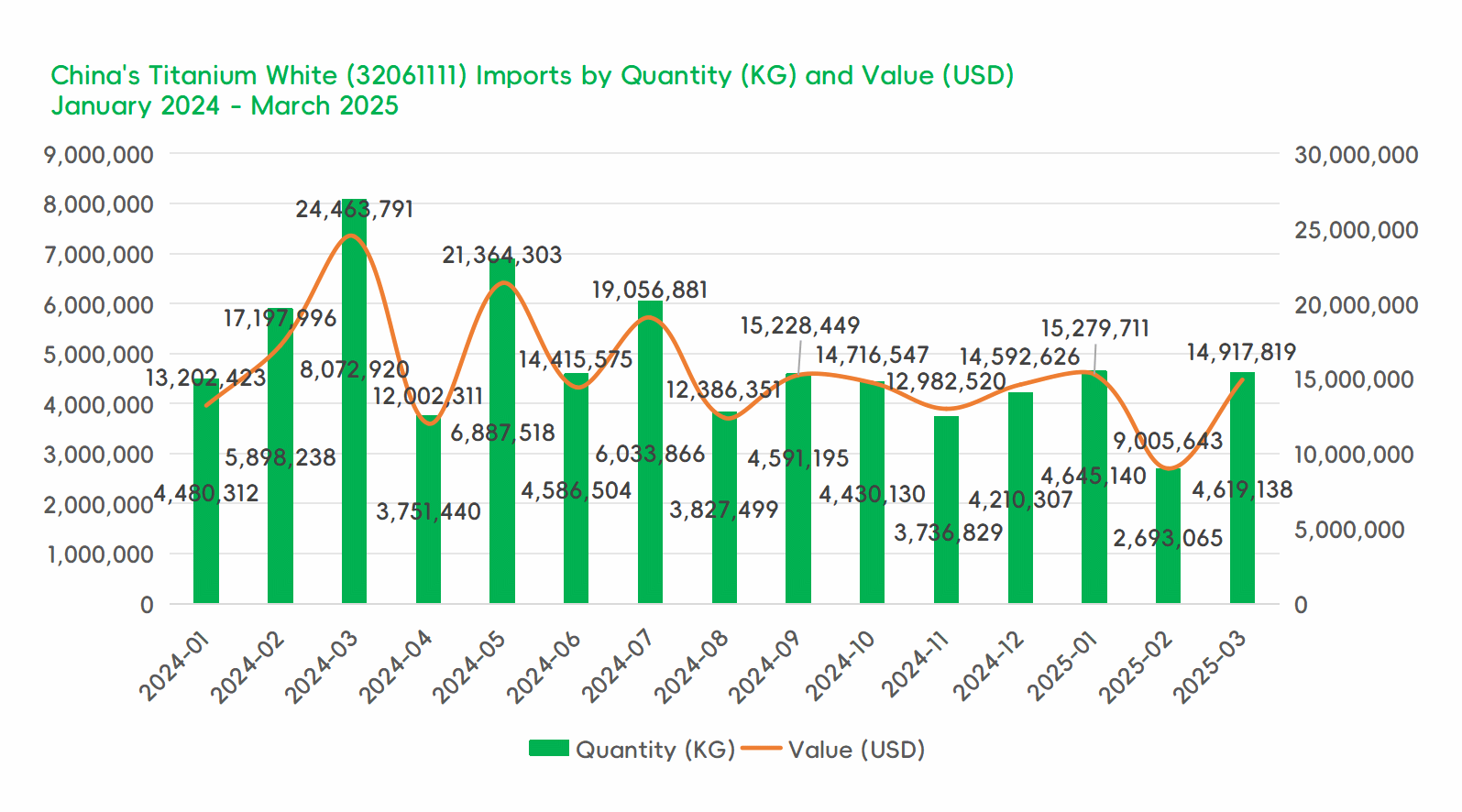

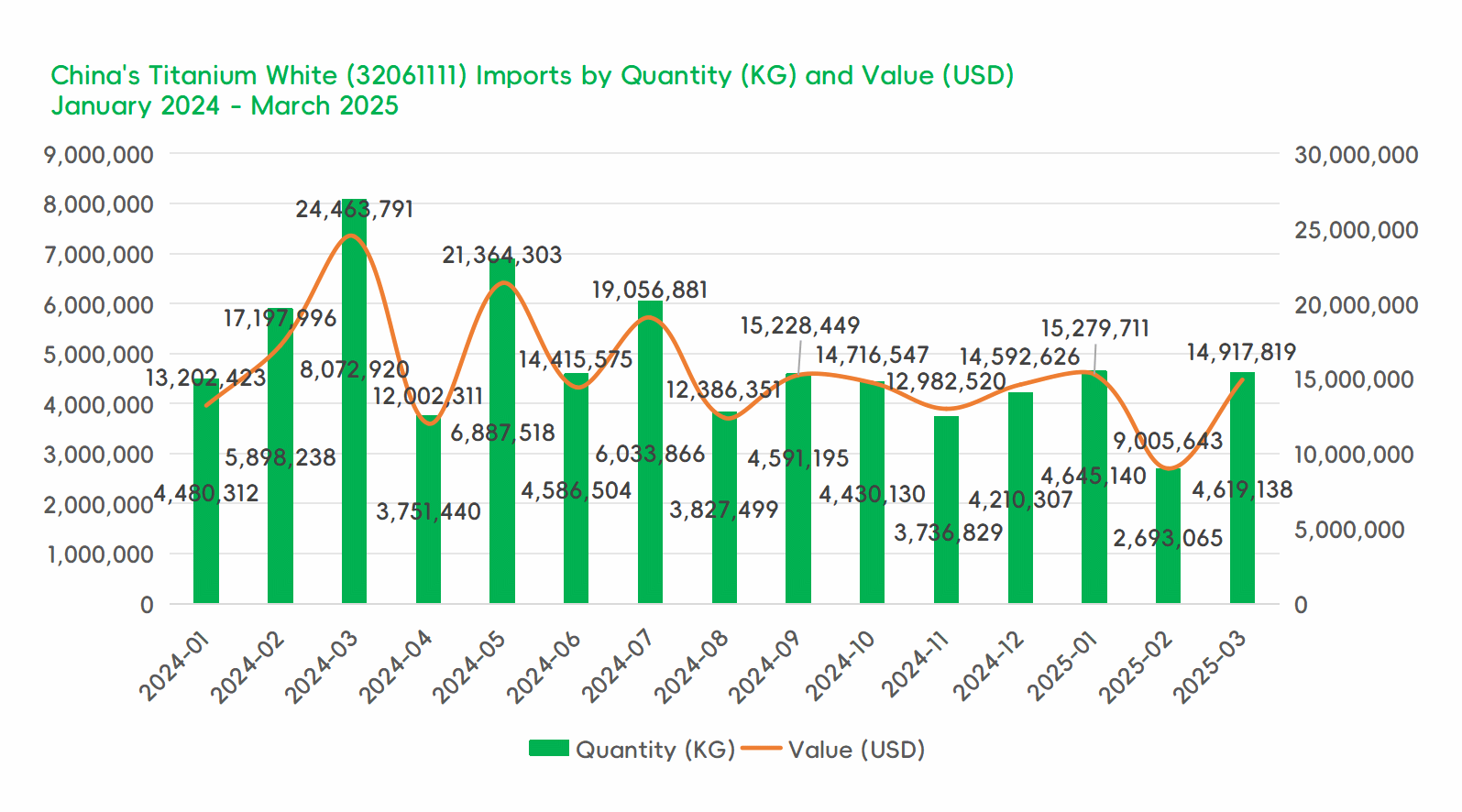

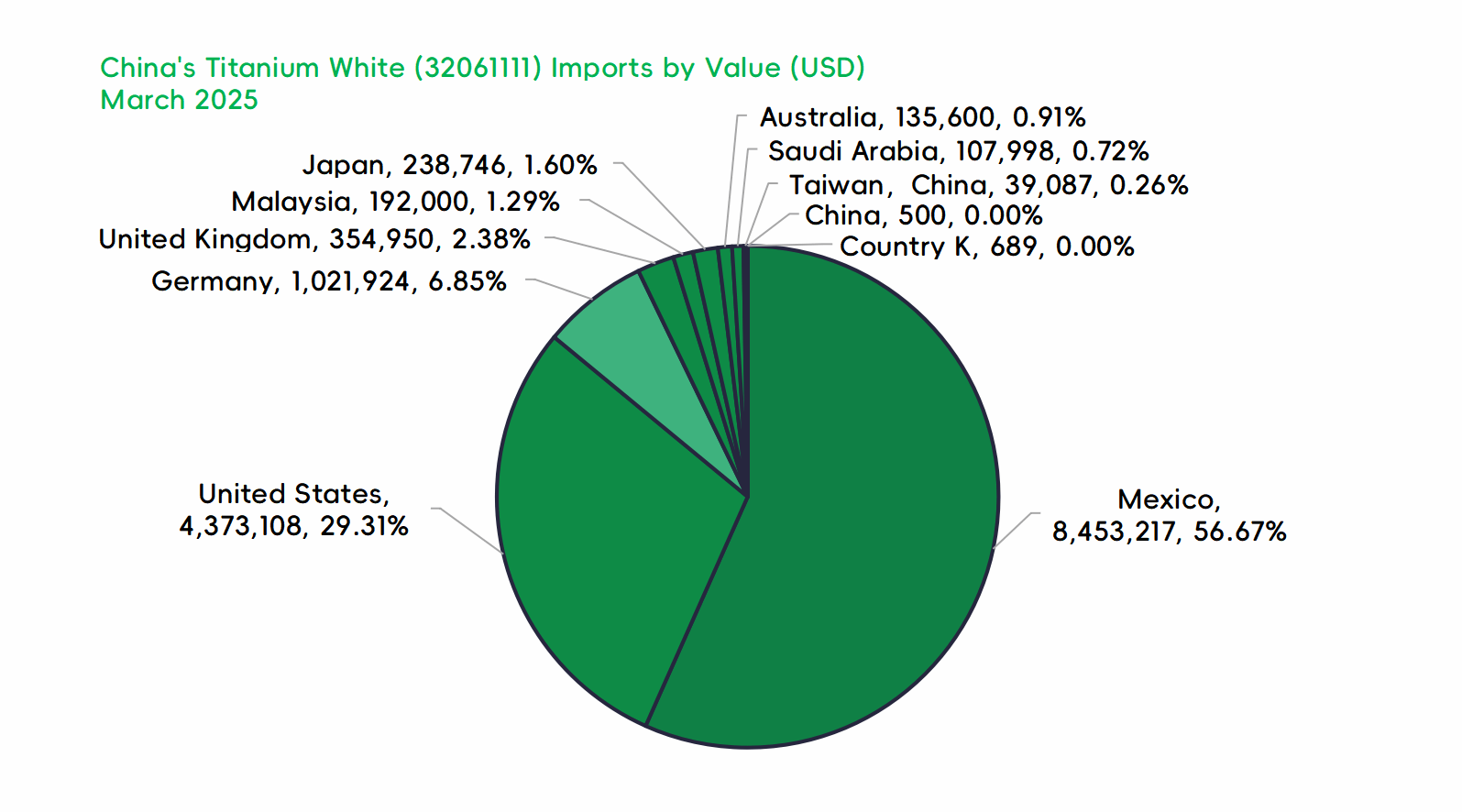

China's Titanium White Imports Surge 65.7% MoM in March 2025, but Drop 39% YoY

In March 2025, China's total imports of titanium dioxide amounted to $14,917,819, reflecting a month-on-month increase of 65.65% but a year-on-year decline of 39.02%.

The total import volume reached 4,619,138 kilograms, up 71.52% from the previous month but down 42.78% compared to the same period last year.

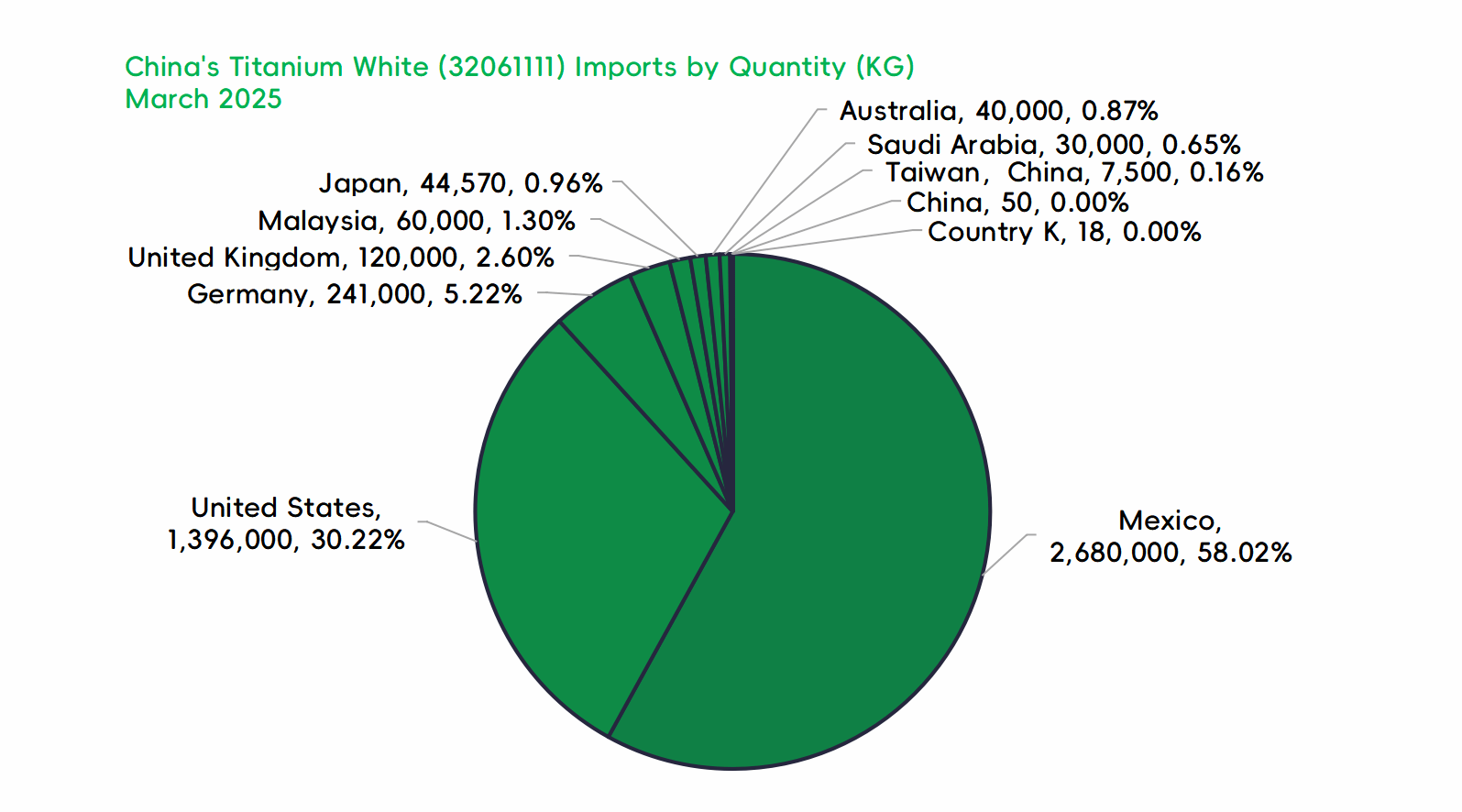

Imports originated from 11 trading partner countries.

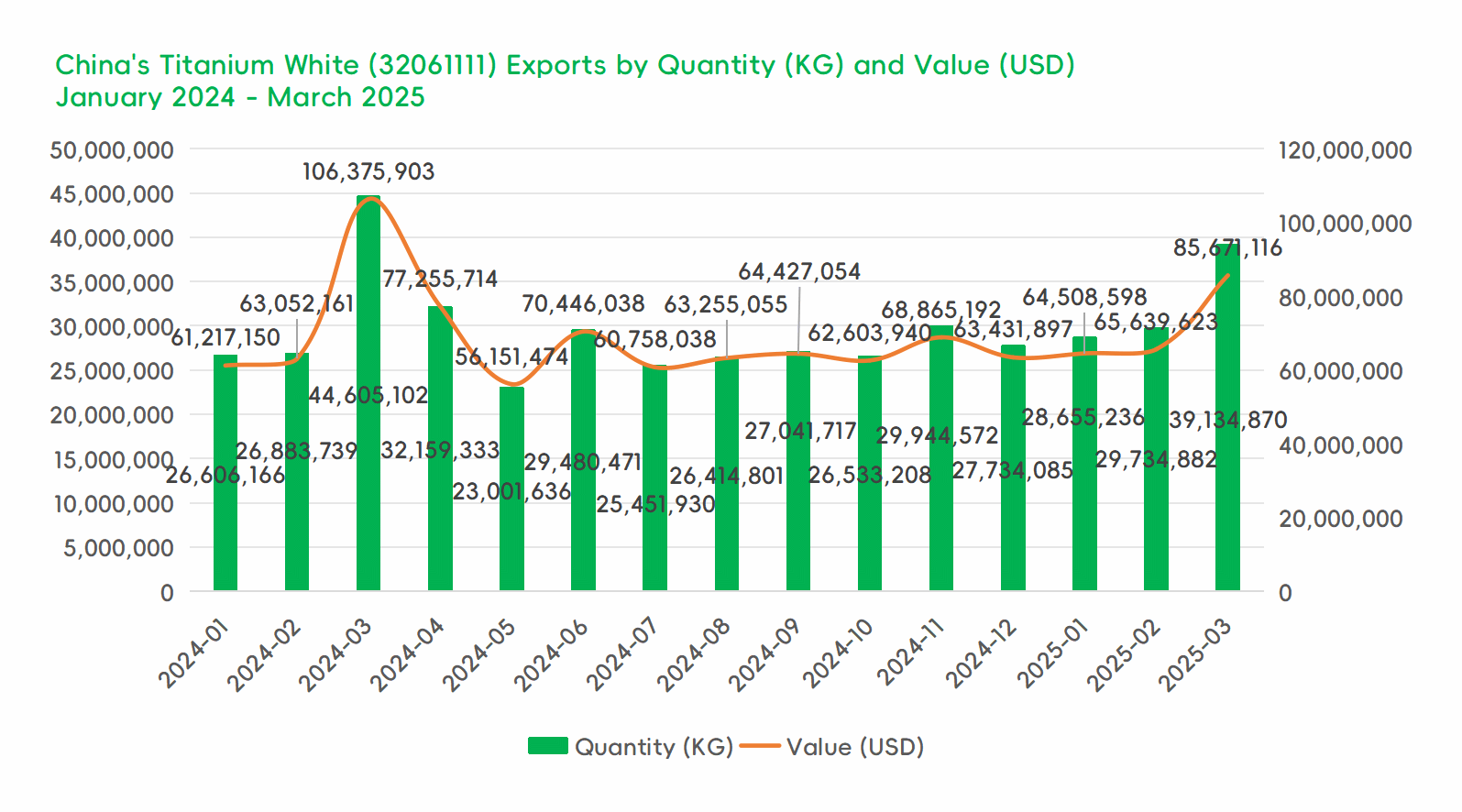

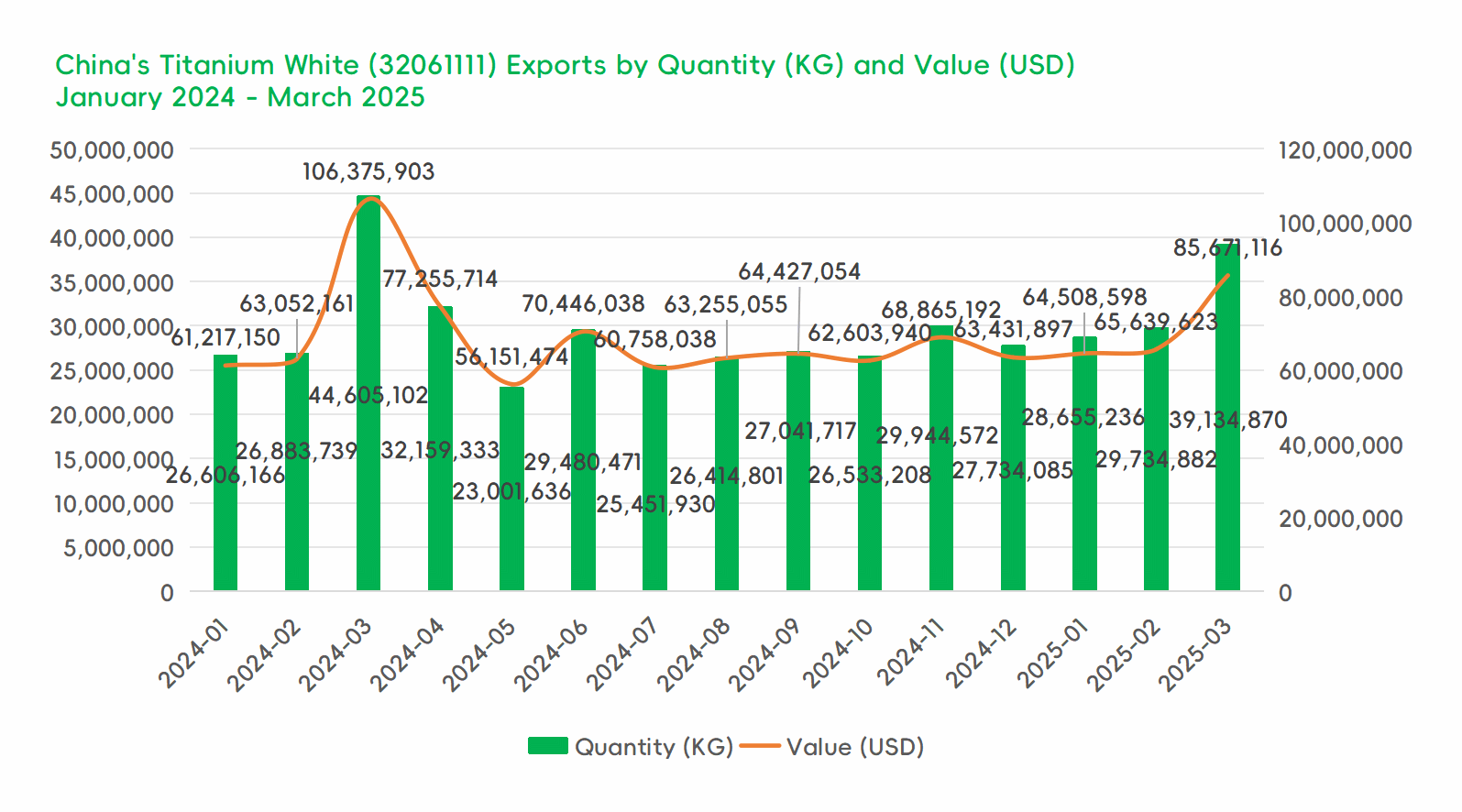

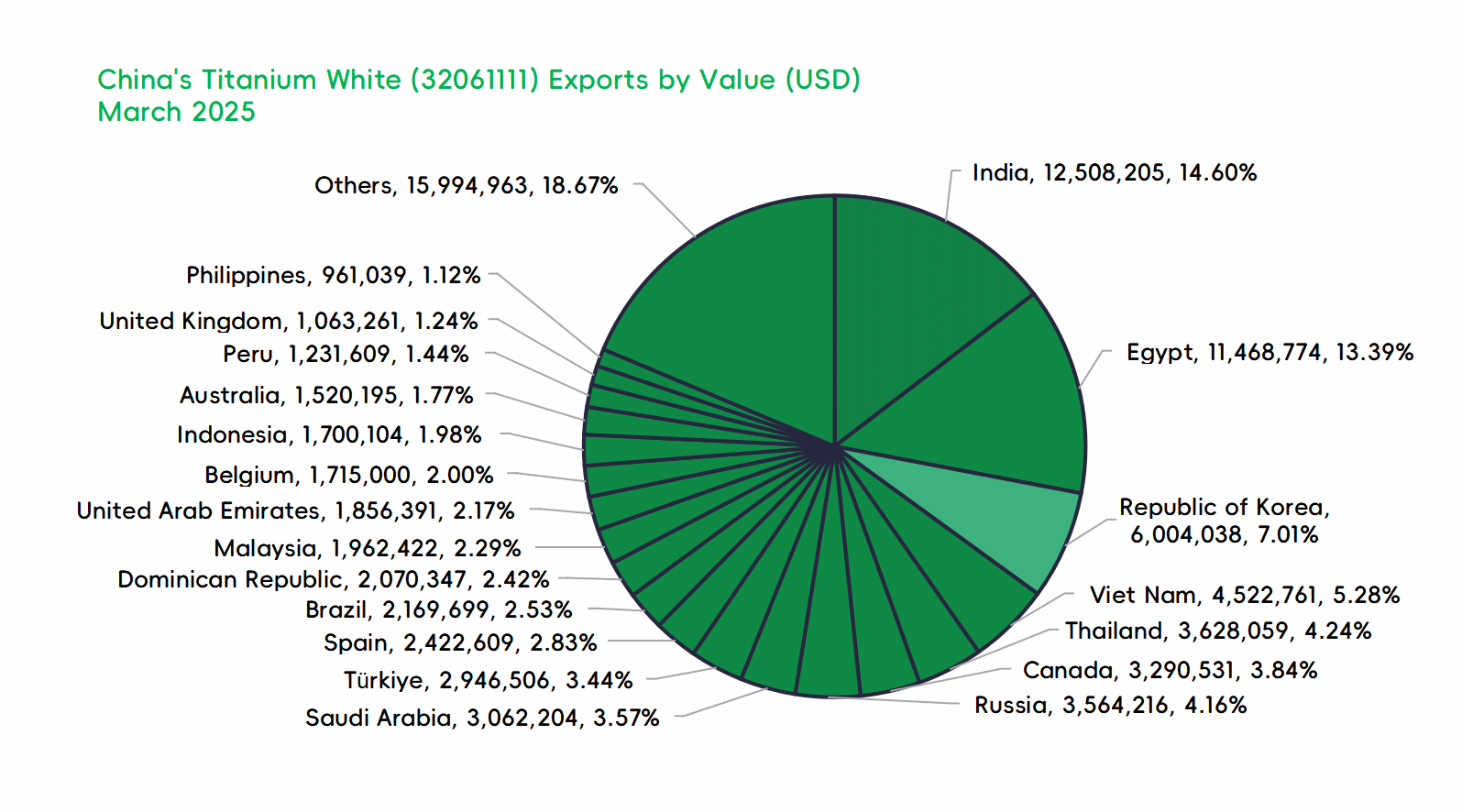

China's Titanium Dioxide Exports Jump 30.5% MoM in March 2025, but Fall 19.5% YoY

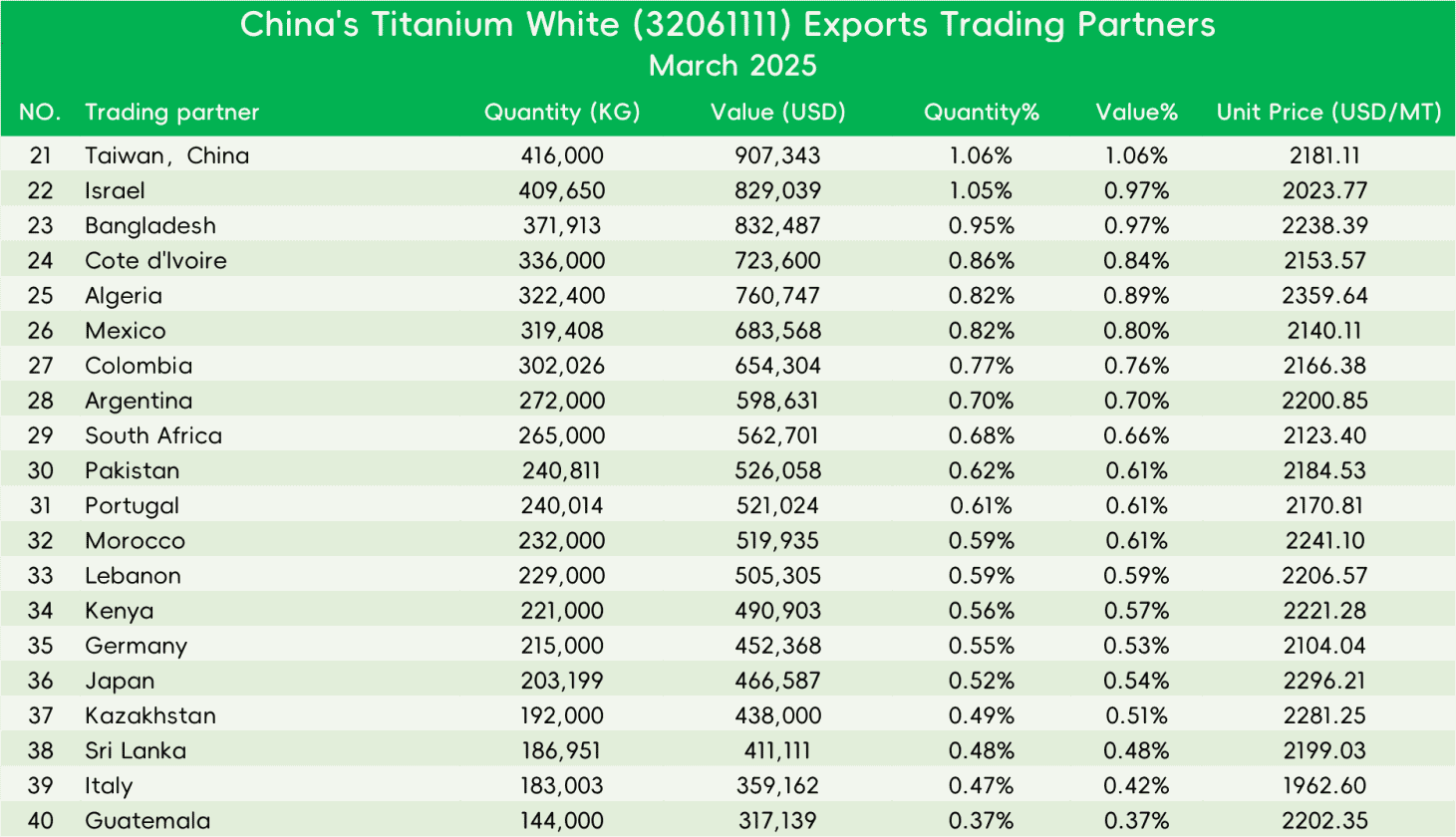

In March 2025, China's total exports of titanium dioxide reached $85,671,116, representing a month-on-month increase of 30.52%, but a year-on-year decline of 19.46%.

The total export volume stood at 39,134,870 kilograms, up 31.61% from the previous month, yet down 12.26% compared to the same period last year.

China exported titanium dioxide to a total of 83 trading partner countries.

China Titanium Dioxide Market Overview – March

During the first ten days of the month, the market remained largely stable.

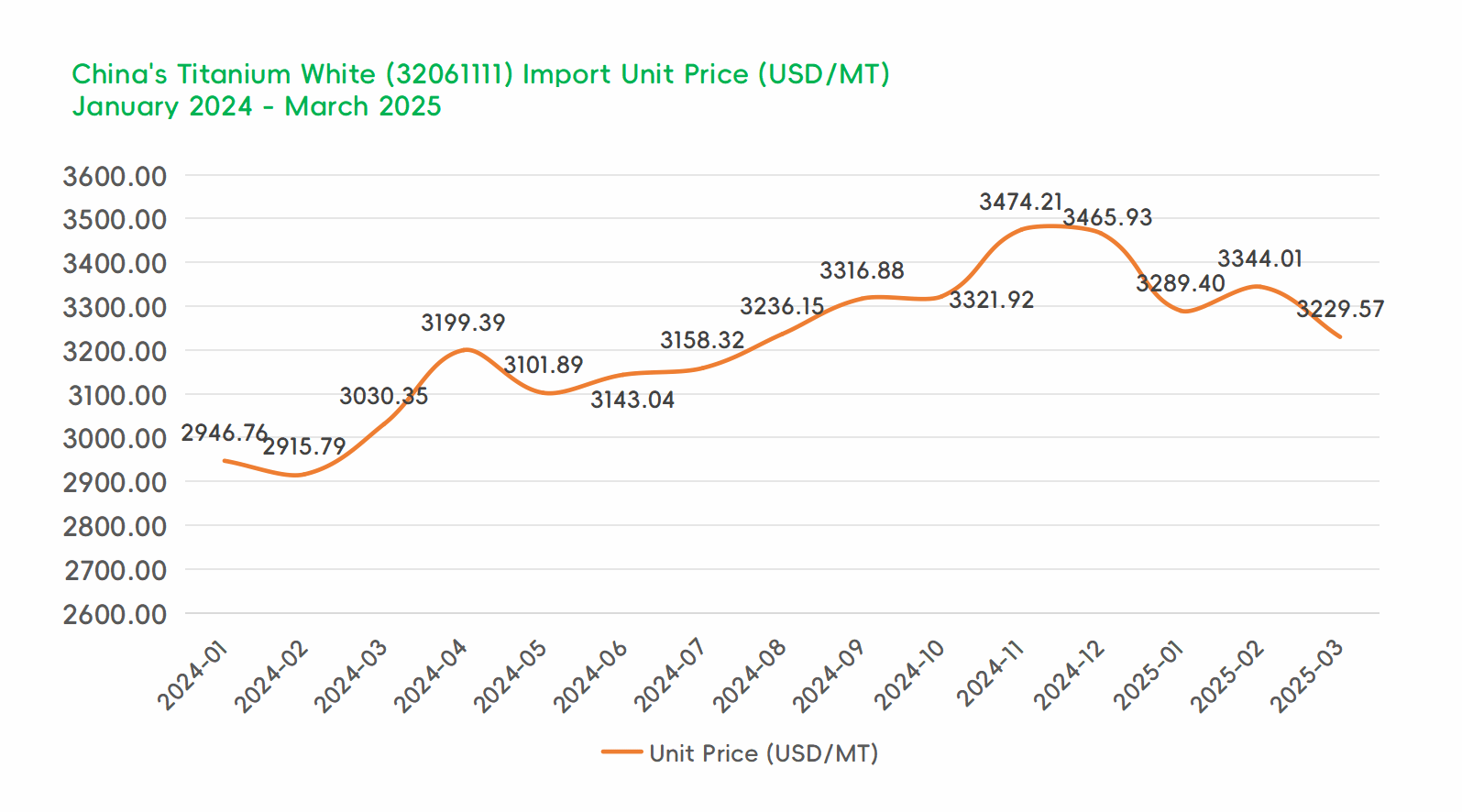

By mid-March, rising sulfuric acid prices and persistently high titanium concentrate prices placed cost pressures on producers, prompting suppliers to adjust their titanium dioxide quotations toward the higher end of the price range.

In late March, several TiO₂ producers issued price increase letters, marking the third round of price hikes in 2024. However, downstream demand fell short of expectations, and market acceptance of the new price levels remained limited.

By the end of March, domestic prices for sulfuric acid-process rutile TiO₂ were mostly quoted in the range of RMB 15,000–16,200 per metric ton.

For the full report, please contact [email protected].

Disclaimer: Blooming reserves the right of final explanation and

revision for all the information.