Titanium Dioxide

About Titanium Dioxide global trade information, exclusive product market analysis, hot news and reports.

-

14 Oct 2025

China Boosts Titanium Dioxide Output with 80,000 Tonnes Annual Production Capacity

On October 10, Bengbu Guotai Nano announced its 80,000-tonne chlorination-based titanium dioxide production line has reached stable mass production after months of trial runs.

-

10 Oct 2025

China's Titanium Dioxide Suppliers Announce Fifth Price Rise This Year

Chinese titanium dioxide suppliers executed their fifth price hike, pushing domestic and export rates higher through late 2025.

-

21 Aug 2025

Lomon Billions' Net Profit Drops Nearly 20% in H1 2025

Lomon Billions Group Co., Ltd. recently released its 2025 half-year financial report. The report shows that the company generated operating revenue of RMB 13.33 billion in the first half of the year, down 3.34% year-on-year.

-

21 Aug 2025

China's Titanium Dioxide Industry Kicks Off First Price Hike in the Second Half of 2025

Recently, Panzhihua Tihai Technology Co., Ltd. issued a price adjustment notice, citing current domestic and international titanium dioxide market conditions and the continued rise in raw material costs.

-

03 Jun 2025

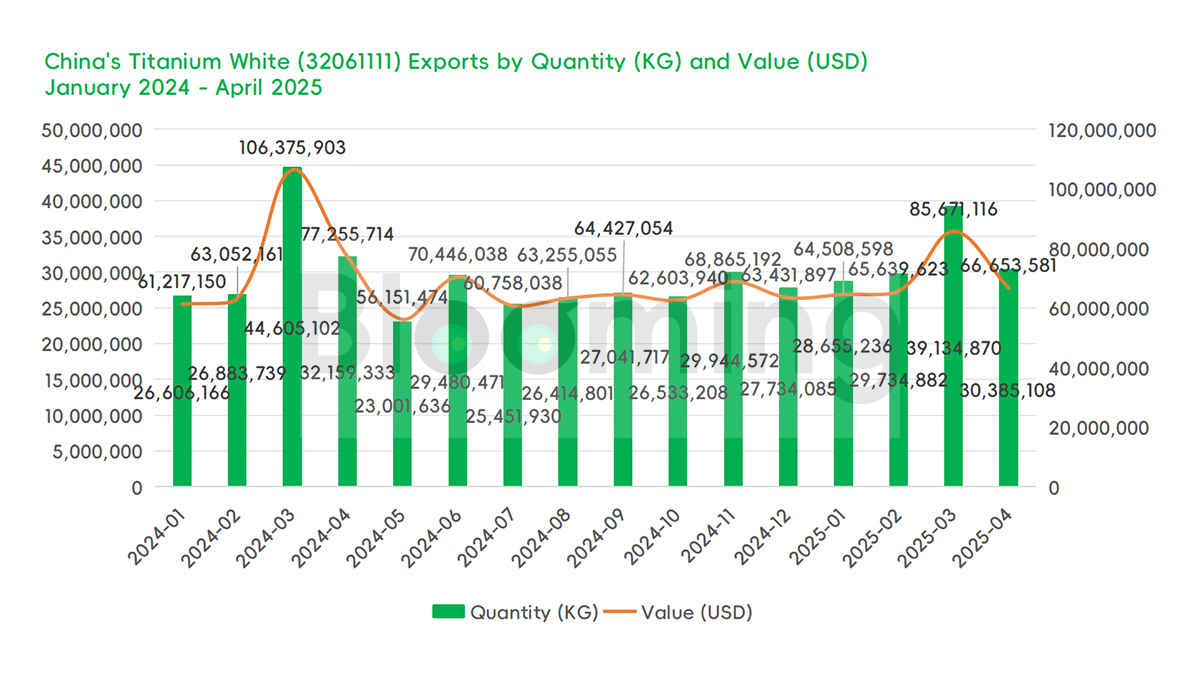

Titanium Dioxide Exports Plunge in April 2025 Amid Intensifying Trade Barriers

China's rutile titanium dioxide exports totaled $66.65 million, reflecting a 22.20% decline month-on-month and a 13.72% drop year-on-year.

-

22 May 2025

Titanium Dioxide Exports Plunge in April Amid Intensifying Trade Barriers

China's titanium dioxide (TiO₂) exports fell sharply to 148,000 metric tons in April 2024, representing a 20.0% decline month-on-month and a 6.0% decrease year-on-year.

-

07 May 2025

China's Titanium Dioxide Trade Sees Strong Monthly Rebound in March 2025 Despite Year-on-Year Decline

In March 2025, China’s total imports of titanium dioxide amounted to $14,917,819, reflecting a month-on-month increase of 65.65%. Exports totaled $85,671,116, representing a 30.52% rise compared to the previous month.

-

21 Mar 2025

Titanium Dioxide Enters Third Round of Price Hikes, Sulfuric Acid & Titanium Ore Indicate Market Trends

Recently, Chinese titanium dioxide (TiO₂) producers, including Shandong Dongjia and Ningbo Xinfu, announced price hikes, raising domestic prices by RMB 500/ton and international prices by USD 70/ton.

-

27 Feb 2025

21 Chinese Titanium Dioxide Companies Announce Price Increases, with a Maximum Hike of 1,100 RMB/Ton

Chinese titanium dioxide prices have surged again, with two consecutive price hikes occurring just one month apart.

-

24 Dec 2024

China's Titanium Dioxide Industry Faces Challenges in 2025 with Production Capacity Approaching 7 Million Tons

In 2024, China's titanium dioxide market was marked by a tug-of-war between supply-demand dynamics and production costs, resulting in a price trend that rose initially before declining later in the year.

-

04 Dec 2024

EU's Antidumping Tariffs on Chinese Titanium Dioxide Trigger Industry Tensions

Last Wednesday, EU member states approved the imposition of final antidumping duties on titanium dioxide (TiO2) imports from China.

-

30 Nov 2024

China's Titanium Dioxide Exports Set to Hit a Record High Despite Domestic Challenges

According to incomplete statistics, over ten titanium dioxide (TiO₂) manufacturers in China are currently either reducing production or halting operations.

-

27 Nov 2024

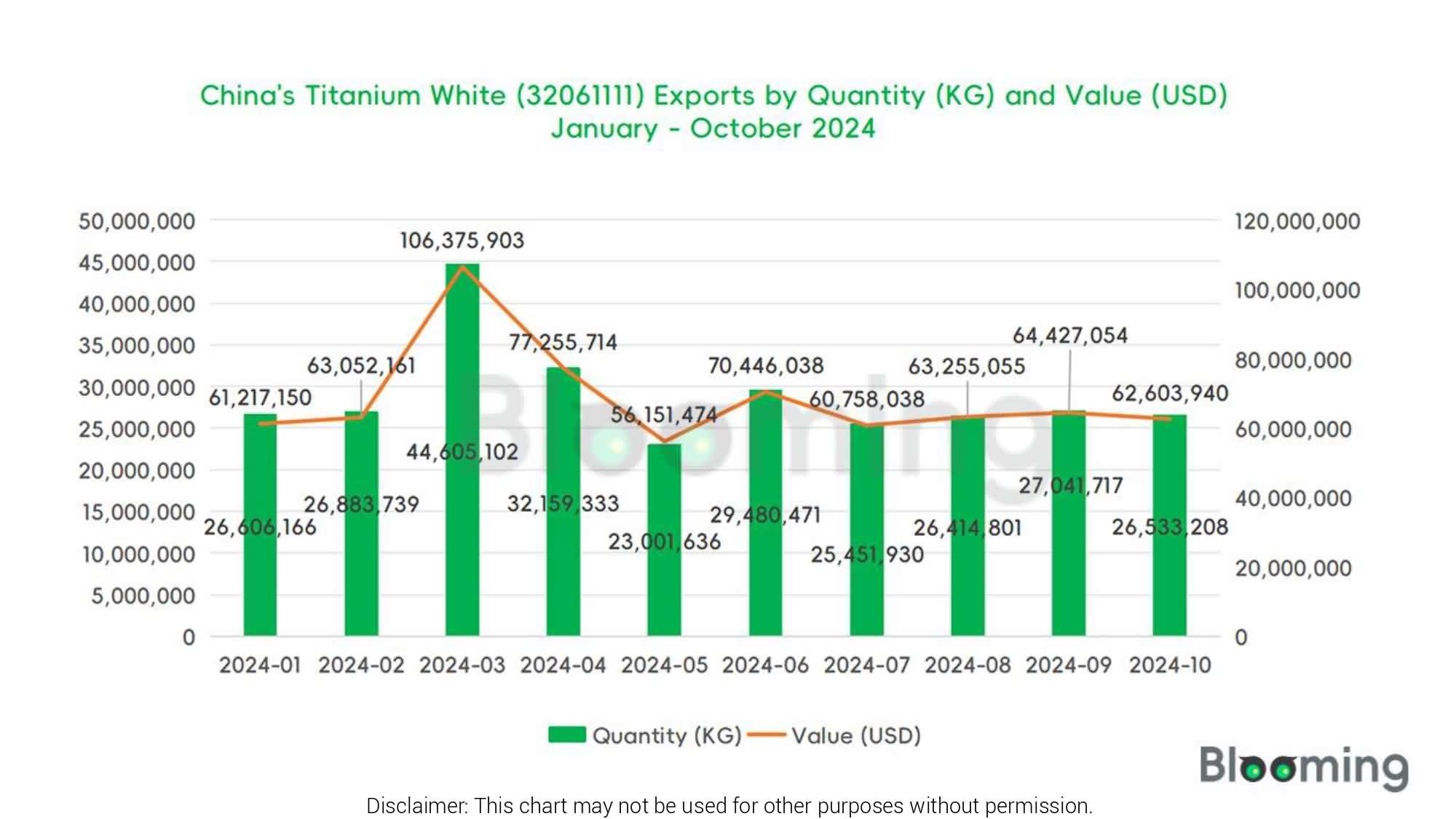

Track the Market Changes of Titanium White in October 2024

In October 2024, China's total imports of titanium white amounted to $14,716,547, representing a month-on-month decrease of 3.36%. Exports reached $62,603,940, marking a month-on-month decrease of 2.83%.